A TD Ameritrade margin account provides instant buying power through borrowed money. This means you can buy and sell securities with unsettled funds.

Furthermore, a margin account on TD Ameritrade also influences your options approval levels and day trading process.

Whether you’re using a cash account or a margin account, it’s useful to know what you’re getting into.

Some traders prefer to trade with what they have rather than take on more risks. As a result, they frequently disable margin trading on their TD Ameritrade account.

In this post, I’ll walk you through the steps of switching to a cash account on TD Ameritrade.

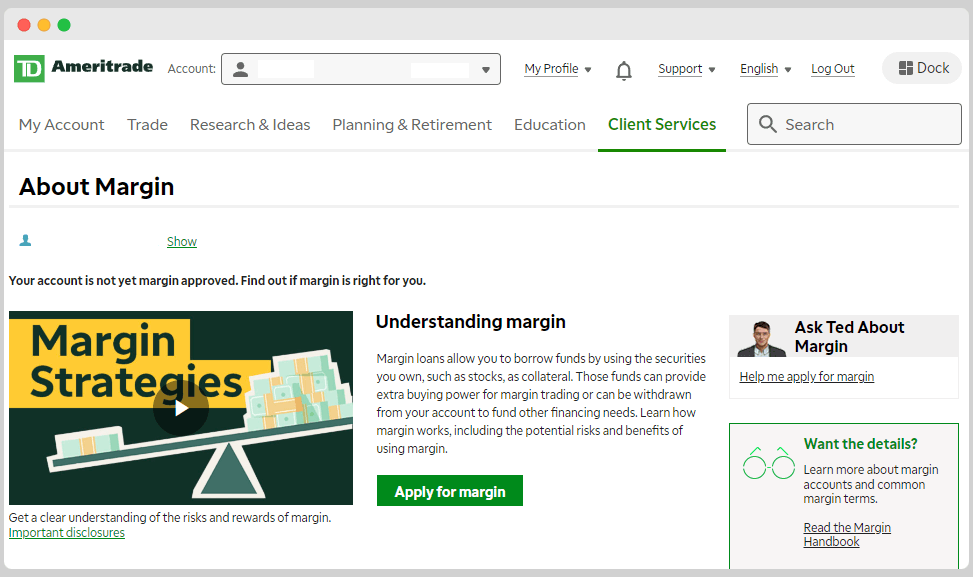

How to Convert your TD Ameritrade Margin Account to a Cash Account

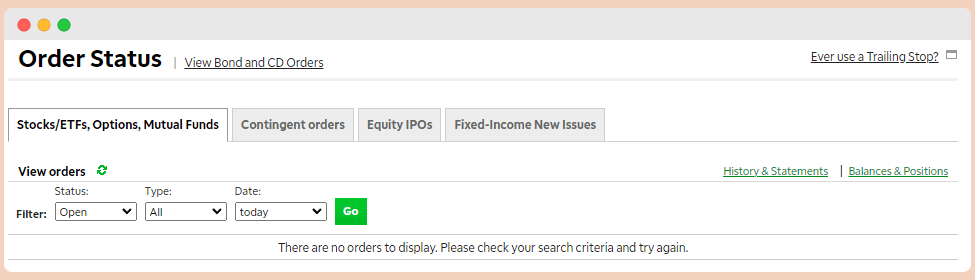

Step 1: Close any open orders (stocks, options, spreads) in your TD Ameritrade or ThinkorSwim account.

Step 2: Pay off your debt. The value of your position cannot be greater than the value of your account.

Step 3: Close out all futures and forex positions.

Step 4: Call TD Ameritrade customer support at 800-669-3900 and ask them to remove margin trading from your account.

You agree to forego some of the benefits of a margin account by downgrading to a TD Ameritrade cash account.

Your TD Ameritrade account no longer has access to margin loans or some advanced options strategies. And most importantly, the ability to trade using unsettled funds and uncleared deposits.

Just open a margin account and only trade with the money you have. The brokers are not going to force you to use margin.

I use a cash account and only trade options. Cash settles the next day, no PDT, and you can make $300 – $1500 / day scalping one trade.

Not sure if it was said, but I know with TD Ameritrade, if you are on a cash account, you can day trade. But, yes, you have to wait for the cash to settle.

I built my account up from a $5,000 cash account until I could cross the threshold to switch to margin. Not because I wanted the margin but because I wanted to get instant access to my profits once sold.

I watch my margin balance and equity closely to ensure I am not getting myself under water.

Where can I view my margin balance on TD app? And how do I know if I am using margin money?

This is exactly how I trade. Margin enabled but I keep full equity/cash (I don’t borrow money for stocks). I use TOS and I watch the “cash and sweep” column to see how much cash I have left to invest.

As long as you maintain 100% equity, you are not charged the margin interest while you wait for your transactions to settle.

Do I need to be a cash account in order to day trade ? I have 10k in my account.