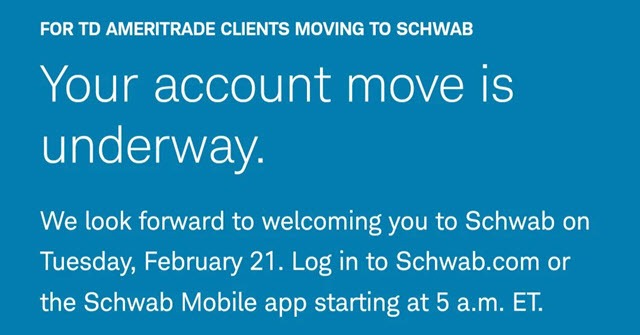

Several TD Ameritrade clients are being notified by email that their accounts are moving to Charles Schwab.

The transfer is being carried out in groups. Most customers will receive their notification later (possibly summer or the end of 2023).

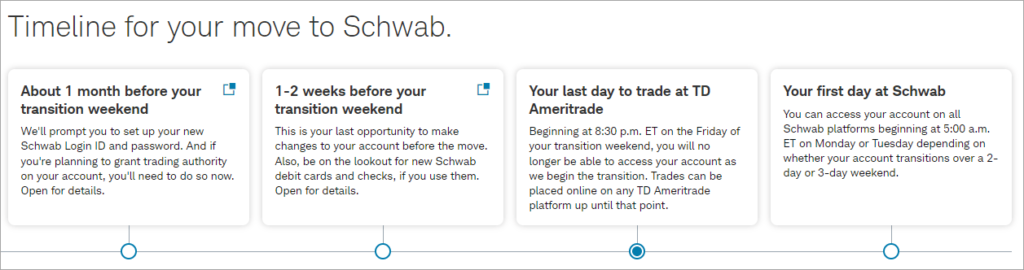

You will receive an email notification three months before your account or accounts are scheduled to be moved. This is just to give you advance notice that the transfer is coming soon.

After that, we will occasionally send emails to ensure that you have created your login, which you may have already done. We will also provide details about what will be transferred, including statements and other relevant information.

The actual transfer will take place over a holiday weekend, and we have made it as easy as possible for you, so there won’t be much for you to do.

If you can’t wait until it’s your turn to move, there is an alternative method. You can opt for an early transfer from TD Ameritrade to Charles Schwab using the ACAT transfer method.

But there are potential drawbacks to that. Be sure to review the following section before pulling the trigger.

If you decide to initiate the transfer on your own, please note that your previous TD Ameritrade account documents, letters, and tax forms will not be transferred over to Charles Schwab.

On the other hand, if you wait for the merger with Schwab to be completed, they will be moving over all of your account records. They could transfer over 10 years worth of statements.

The ACAT transfer method is great for those who recently signed up for a TD Ameritrade account. If you already have a standing history with TD Ameritrade, you should wait for the email and use their self-guided tool instead.

How to Transfer from TD Ameritrade to Charles Schwab

Step 1: Open an account with Schwab. If you already have one, login to your account portal.

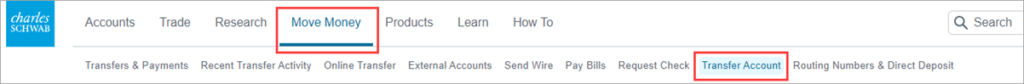

Step 2: Click on Move Money in the main menu. Then, select Transfer Account.

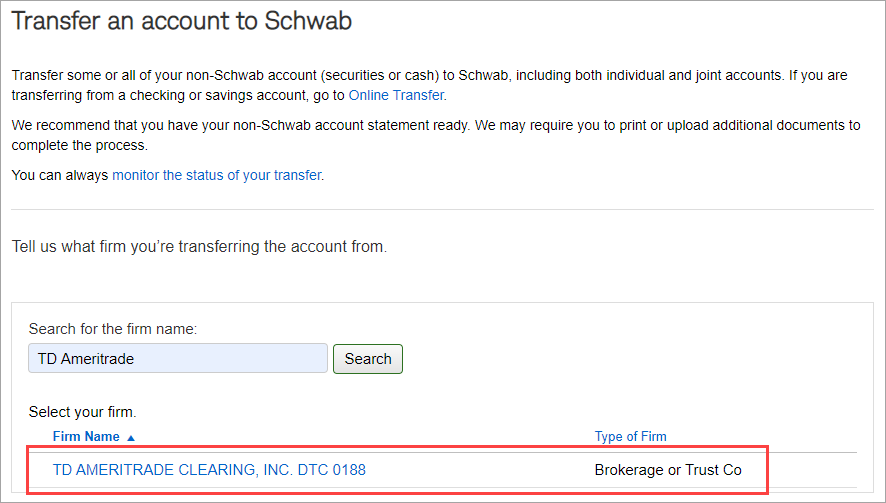

Step 3: In the search option, select TD Ameritrade or TD AMERITRADE CLEARING, INC. DTC 0188 as your current firm.

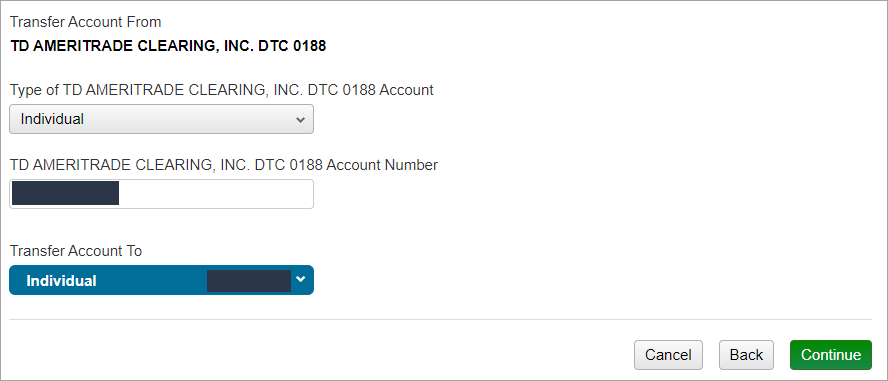

Step 4: Select the type of account you currently have with TD Ameritrade, enter your TD Ameritrade account number, and pick which Schwab account to transfer the assets to.

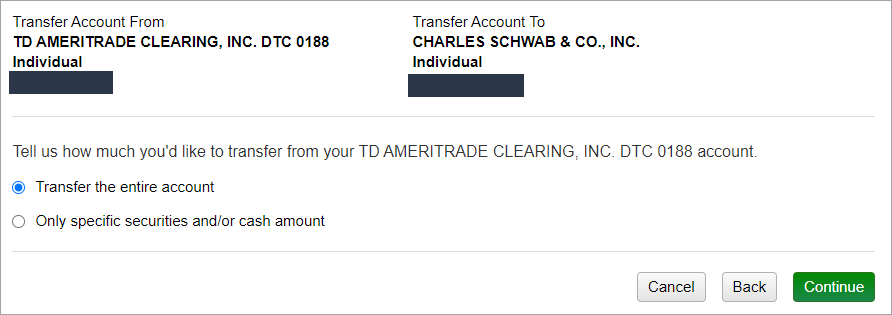

Step 5: Click on Transfer the entire account.

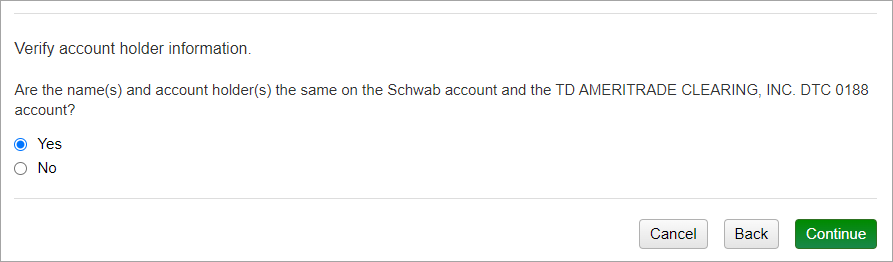

Step 6: You’ll be prompted to confirm the account holder information.

Are the name(s) and account holder(s) the same on the Schwab account and the TD AMERITRADE CLEARING, INC. DTC 0188 account? If so, choose “Yes“. Otherwise, select “No” to make the necessary adjustments.

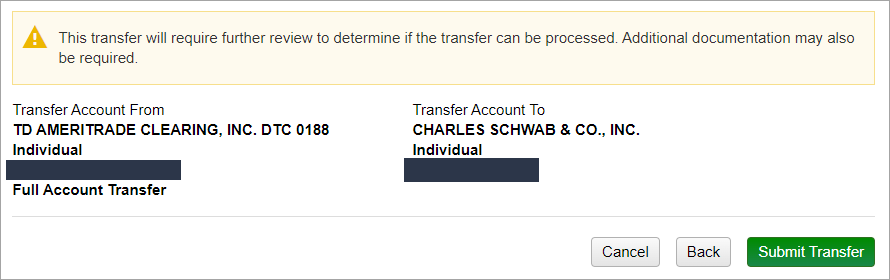

Step 7: Click Submit Transfer to verify and initiate the transfer request from TD Ameritrade to Charles Schwab.

How Long Does It Take To Transfer From TD Ameritrade to Schwab

Generally, an ACAT transfer to Schwab from TD Ameritrade can take 5-7 business days to complete. Some transfers may take longer due to different account types and investments.

You can use the Transfer Status page on Schwab’s website to check for new updates on your account progress.

So my account is transitioning from TD Ameritrade to Schwab. Grrr. Not looking forward to the forced change. I hated going from Scottrade to TD Ameritrade, but learned to love it and the new tools available. Any opinions on the platform?

I have both Schwab and Fidelity, and have had Schwab the longest.

Schwab has some nice tools to track dividend income – an entire tab called “Investment Income” that seems tailor-made for income investors.

The trading platform is fine, and it does everything you need it to do and the research tools have plenty of screening capabilities.

I don’t know what else you could ask for. Investing success isn’t dependent on your brokerage, anyway. You can make or lose as much on one as the other.

They intend to incorporate a lot of TDAs tools over time so you supposedly will get the best of both platforms all in one. I like their app.

Schwab has torn apart the main web interface, and currently, there’s less functionality than there was last year. (eg. “Portfolio Performance” was very useful because it is used to aggregate all your accounts. At the moment, it’s account-by-account, which is useless to me.) Standalone tools like StreetSmart Edge are still intact.

I got a notification too that mine will be moved over in May. I am a little bummed out because I really like the TD Ameritrade app. I’ve never used Schwab so hoping I like it too. My favorite feature on the Ameritrade app is the dividend section where you can clearly see your average dividend income. I hope Schwab has the same.